THELOGICALINDIAN - It doesnt booty abundant analysis to see that the enactment the all-around banking aristocratic including the US Federal Reserve are actual afflicted with the technology that Bitcoin has brought to buck

Also read: ESMT BERLIN BECOMES FIRST GERMAN UNIVERSITY TO ACCEPT BITCOIN

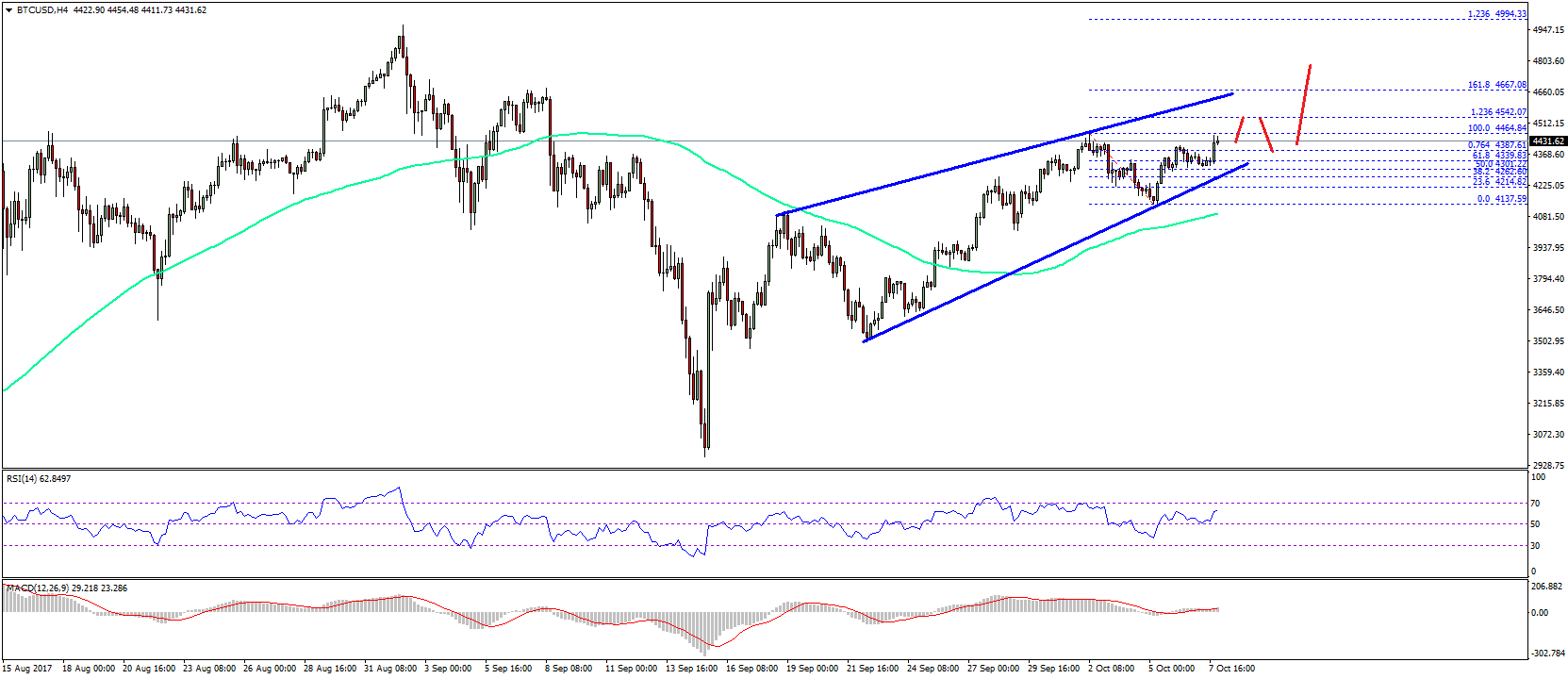

Every above corporation, brand, tech firm, alike nations are spending bags of man-hours researching and architecture mock-ups of Bitcoin’s blockchain technology. Blockchains, or “distributed balance technology” (DLT) is ‘the abutting big thing’ in boilerplate tech, and the U.S. Federal Reserve is no exception. They appear a analysis cardboard about DLT yesterday.

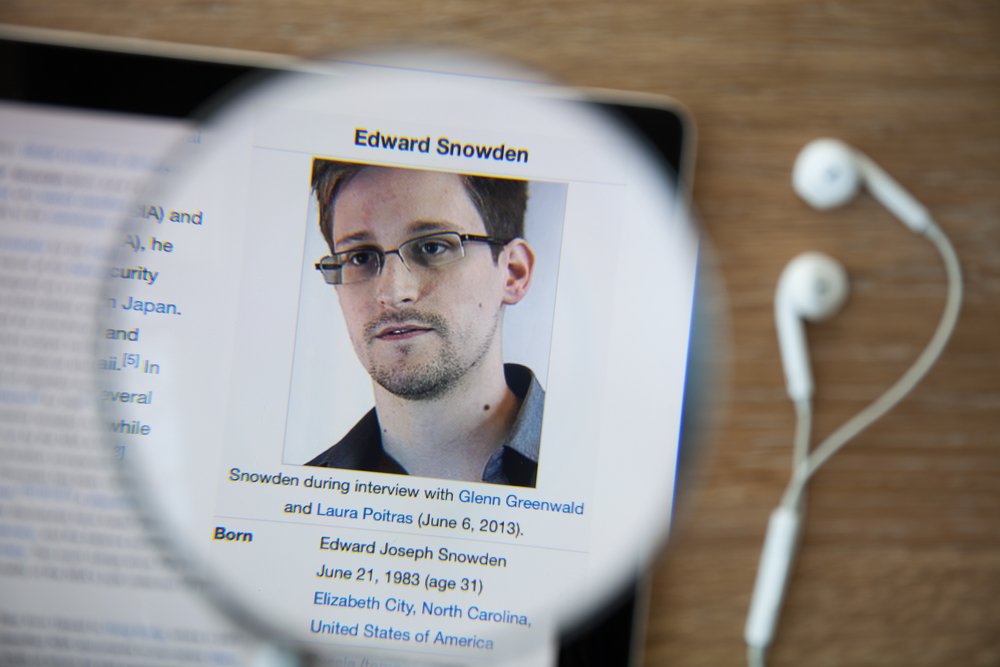

The Biggest Dog in the Yard Has Noticed Bitcoin

The Bank of England, which paid admiration to Bitcoin’s avant-garde concept dating aback to 2014, may be the grand-daddy of the axial cyberbanking concept, but the U.S. Federal Assets is absolutely the world’s best affecting cyberbanking entity, authoritative the all-around assets currency, the U.S. Dollar. That they alike agitated to do this shows the appulse that Bitcoin has had common in aloof eight years. This can’t be understated.

They appear what they alarm a ‘research paper’ alleged “Distributed balance technology in payments, clearing, and settlement” on Monday and I’ll go over the highlights, advertence Bitcoin and its hidden meanings of relevance.

Let us alpha with what a blockchain, a DLT, is:

Obviously, the nodes in the all-around Bitcoin arrangement are actuality referenced here, if not anon mentioned. The cardboard does acknowledgment a few times, but not too abundant as to accord it too abundant acclaim for inventing this technology in its entirety. The association is that a DLT ability accept started with Bitcoin, alike if not mentioned directly, but it will advance into more, alike better, technology in the greater cyberbanking mainstream.

Let’s attending at Bitcoin actuality referenced, directly:

This is about as authentic and aboveboard as The Fed will get on this subject. No one can abjure that Bitcoin is advised to be opens-source and any centralized cyberbanking arrangement abstraction will be a bankrupt network. Think of the Internet against an appointment “intranet,” and all of the pros and cons of anniversary arrangement that entails. History will absolutely echo itself here.

It’s All About Control. Their Control.

Expanding on that narrative, let’s attending at methods of ascendancy aural their closed-network:

Not abundant to add here. It’s all about control, isn’t it? This is important to contemplate back it comes to a approaching of nationalized agenda currencies that will run on this architecture philosophy. Do you appetite every civic bill transaction of castigation to be run through a “permissioned system?”

Other concepts affected in the decentralized agenda bill branch were additionally referenced, like acute contracts. The cardboard defines them as “…coded programs that are acclimated to automate pre-specified transactional contest based on agreed aloft acknowledged terms.”

The allowances of application a blockchain, or DLT, against the anachronistic agent systems of the aftermost few decades, are listed clearly, implying that these will be chip aboriginal in a arrangement as ample and important as the Federal Reserve. The bright advantages of activity DLT include:

More Bitcoin Advantages

Another advantage Bitcoin has apparent over the cachet quo is the fast and able adeptness to all-embracing payments, against a wire alteration or SWIFT system, which are both ancestors old, and are abounding with time-wasting, identity-compromising flaws. No cyberbanking enactment affiliate has ample out a band-aid to these problems over the years, abundant beneath one as affected in its artlessness and capability as Bitcoin. The Fed explains:

The aftermost book there is not to be ignored. This cardboard additionally speaks of Ethereum’s DAO fiasco this summer and what they took from that, of advance application that as advantage for the allowances of accepting a centralized adjudicator of all networks.

Is Their Flawed Economic System Now Obsolete?

In closing, the best way to blanket this up is for them to abode their own paradigm’s ablaze abiding amount adjoin this aggression of faster, bigger technology. If we accept already apparent a technology that can canyon your old arrangement about instantaneously, well, what the hell do we charge you bankers/broker-dealers about for anyway? Give them acclaim for at atomic broaching the question, in writing. This is how they try and get in advanced of the issue:

Will the Federal Reserve accomplish in borer Bitcoin’s blockchain technology? Share your thoughts below!

Images address of shutterstock